Interdisciplinary Approach

Specialized, Sector Focus

Our team has invested across multiple economic and commodity price cycles spanning over two decades. We look for high quality assets or companies capable of generating significant cashflow that are often misunderstood, overlooked or simply undervalued by the market.

It is our experience that the cyclical nature and interconnectedness inherent across the commodities sector confers a competitive edge to specialist investors who are able to act quickly to capitalize on periods of industry transition, market dislocation, or situational complexity that give rise to mis-pricings.

Sectors we Target

Write your title here. Click to edit.

This is a paragraph where you can add any information you want to share with website visitors. Click here to edit the text, change the font and make it your own.

A Different Approach

Inter-Disciplinary Perspective

We take a unified approach to deploying capital, spanning multiple investment disciplines across public markets, private markets, distressed credit, restructuring and litigation.

The cross-pollination of insights across markets often leads to a differentiated perspective. Together with our flexible capital model, this allows us to invest tactically across market cycles which we believe greatly enhances risk-reward.

Comfort with Complexity

We are known for tackling complex problems to unlock value for our partners and the companies in which we invest.

We view ourselves as problem solvers seeking to find innovative financing solutions to support businesses or industries experiencing temporary dislocation.

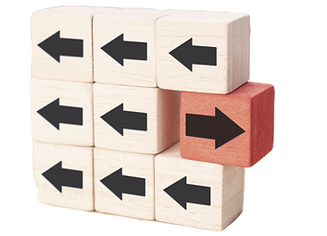

Contrarian Bent

We have found that contrarian investing in commodities often confers the most attractive return opportunities in businesses overlooked or misunderstood by others.

It is during periods when most traditional investors are unwilling or unable to allocate capital that we have historically been the most active.